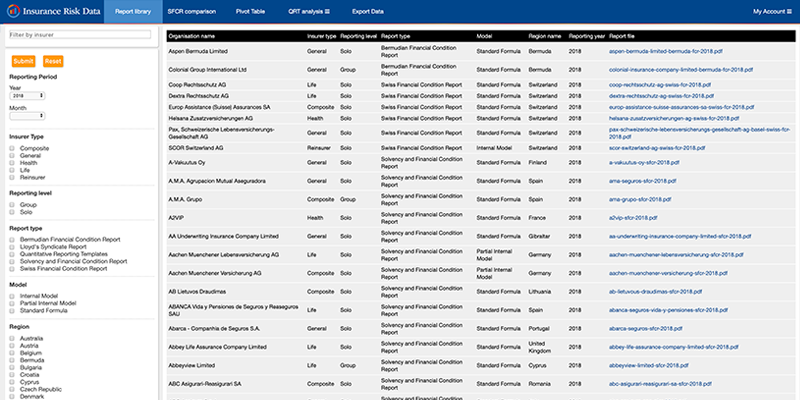

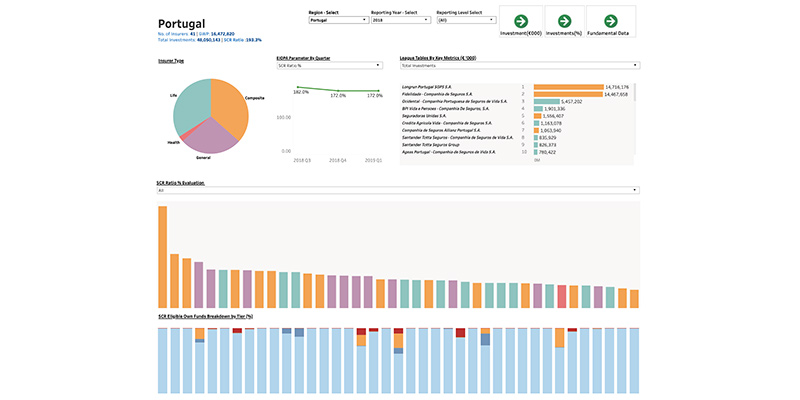

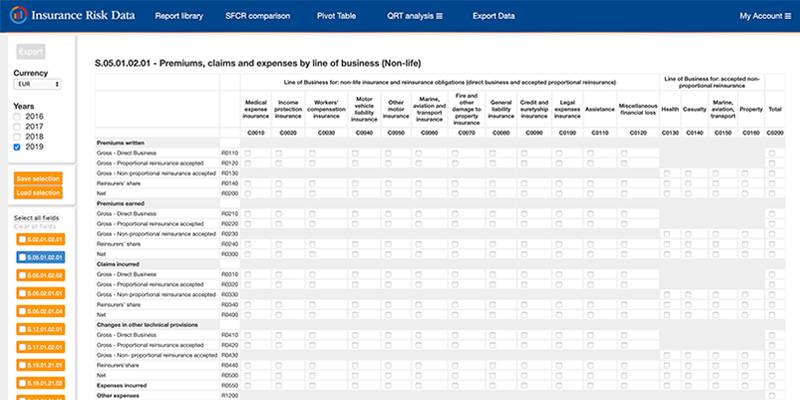

Data and insight for insurance sector analysis, research and benchmarking

Financial, investment and regulatory data and reports for over 3,000 insurers across UK, Europe and Bermuda. Includes Solvency II data and reports.

Comprehensive * Reliable * Insightful