Insurance Investment Outsourcing Opportunities Report - Europe and UK 2024

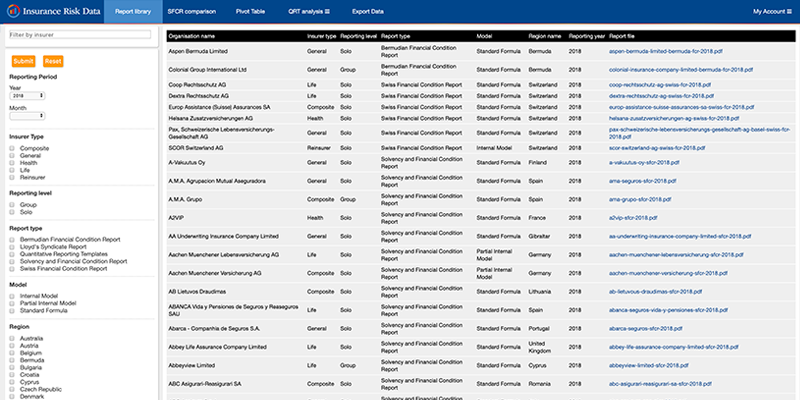

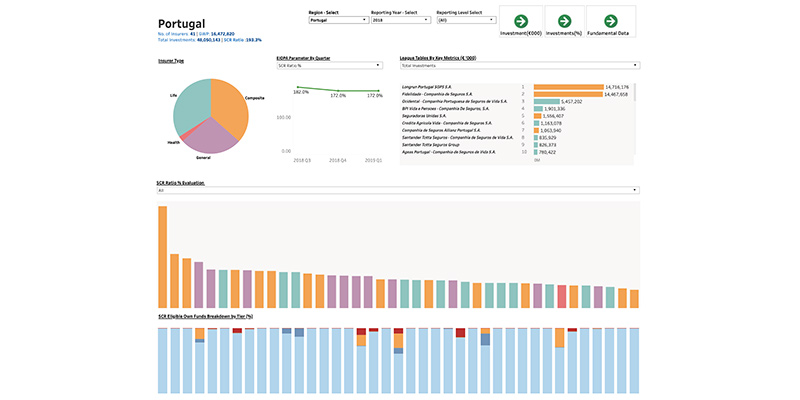

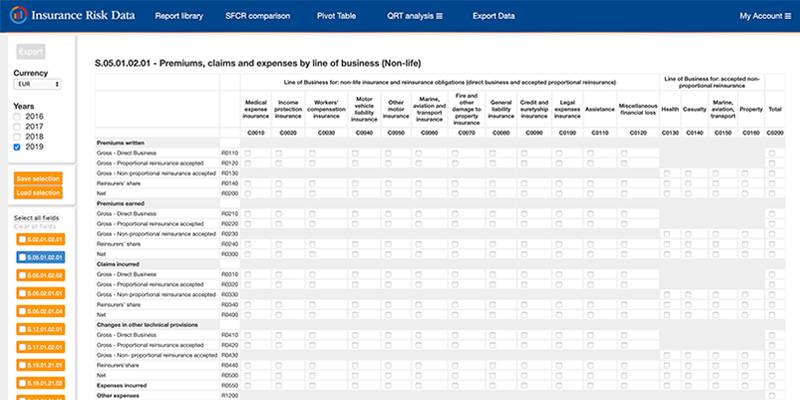

The sixth comprehensive annual report on how insurers in Europe and UK, (including Lloyd’s syndicates), invest and outsource their investing activity. 350 pages and 300 exhibits, providing analysis on themes and including details such as size of General Account and unit-linked assets, mandates, managers used, details of mandates and names of investment decision-makers. It includes details of over 2,000 acts of delegation, between about 1,200 insurers in Europe and more than 500 different managers. Ideal for investment managers, asset managers and consultants involved in insurance investment strategy, planning, analysis, research, business development, sales and marketing. A report purchase includes PDF report, Excel Data Chartbook and access to an analyst to discuss report findings.

Download the report